62% of Merchants Eye NFTs as Part of Loyalty Schemes

- Checkout.com report shows strong merchant support for crypto payments.

- 62% of merchants plan to introduce digital tokens or NFTs as part of loyalty schemes.

- 23% of online businesses plan to offer crypto payment methods by 2024

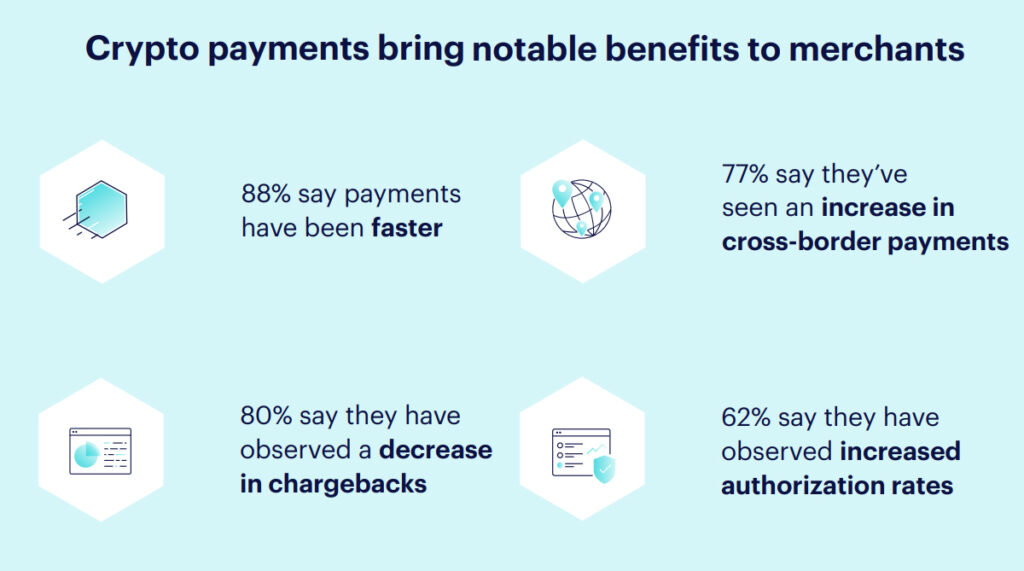

The number of merchants and online businesses planning to introduce crypto in the near future is increasing rapidly, according to a recent report released by Checkout.com. Approximately 62% of merchants want to introduce digital tokens or NFT as part of loyalty schemes, while 23% of online businesses say that they plan to offer crypto payment methods by 2024.

The survey was posed to 3,000 entities, mostly platform-based online B2C marketplaces, fintech, and e-commerce businesses across ten countries. The biggest group of respondents came from the United States, with others split between major economies like Australia, France, Germany, and the United Kingdom. The respondents themselves were in the 25 and 45 year age bracket.

The report notes that crypto appears to be moving towards the mainstream, with 40% of the 18–35 year-olds saying they would like to pay for goods and services with crypto during the course of 2022. This is a considerable number, but it is worth noting that the sample is a small portion from select countries.

Perhaps governments and officials will take note of the results of surveys like this. For the most part, lawmakers have chided crypto as being too volatile, but there is some hope in the form of stablecoins, which 77% of merchants said offered an increase in cross-border sales.

Adoption Getting Bigger and Bigger on the Horizon

The data from the report is in line with other reports and trends in the market, which has shown a marked increase in online retailers and merchants in recent months. As governments have become open to the crypto asset class, retailers have become amenable to the idea of using it for payments.

Challenges remain, of course, and there will be some time before the widespread use of crypto as a payment means becomes a reality. Volatility is one of the top concerns, though stablecoins address that problem. However, there has been worry surrounding stablecoins from a regulatory perspective, but the market should see soon enough how officials tackle this.

In any case, as the report notes, friendly crypto regulation can result in many benefits for both merchants and customers. This can drive the economy forward and create new pathways for businesses, which have been hurt by the pandemic.

Powered by WPeMatico