Tether Reduces its Commercial Paper Holdings in Favor of US Treasuries for its Reserves

Quick take:

- Tether’s CTO has stated that the company has reduced its holdings of commercial paper and increased its US Treasuries as reserves for USDT

- Tether also announced that the USDT stablecoin had stood the test of time

- USDT also suffered depegging this week as stablecoins were in the spotlight after UST’s and LUNA’s depreciation in the markets

Tether’s and Bitfinex’s CTO, Paolo Ardoino, has updated on the status of USDT reserves during a Twitter Spaces chat on Thursday. According to Mr. Ardoino, the majority of Tether’s reserves are in US Treasuries after the company reduced its exposure to commercial paper over the last six months.

Tether (USDT) had Depegged from the $1 Mark

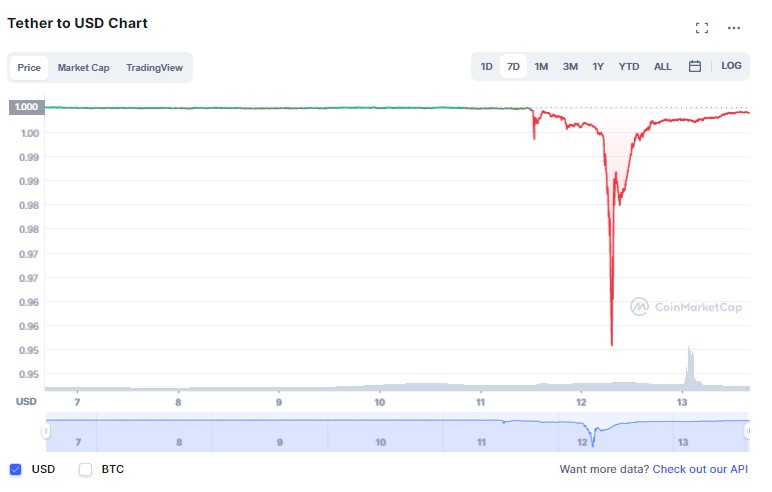

The update on Tether’s reserves comes in the backdrop of USDT depegging as crypto-traders and users panicked as UST depegged and LUNA underwent severe inflation. At the height of Tether’s depegging, USDT was trading as low as $0.95, but the stablecoin has since resumed to $0.9988, which is very close to the $1 mark.

Tether Issues a Statement Explaining that USDT has Withstood other Black Swan Events

The depegging of Tether and the subsequent anxiety surrounding the future of USDT resulted in the team at the company issuing a statement to allay any fears in the markets. They explained that it was ‘business as usual [for USDT] amid some expected market panic following this week’s market movements.’

In addition, the team at Tether explained that USDT redemption continues at a 1:1 ratio with the US Dollar. They also added that this was not the first time Tether’s stability had been tested. They said:

Tether has maintained its stability through multiple black swan events and highly volatile market conditions and even in its darkest days Tether has never once failed to honour a redemption request from any of its verified customers. Tether will continue to do so which has always been its practice.

Tether is the most liquid stablecoin in the market, backed by a strong, conservative portfolio that consists of cash & cash equivalents, such as short-term treasury bills, money market funds, and commercial paper holdings from A-2 and above rated issuers.

[Feature image courtesy of Unsplash.com]

Powered by WPeMatico